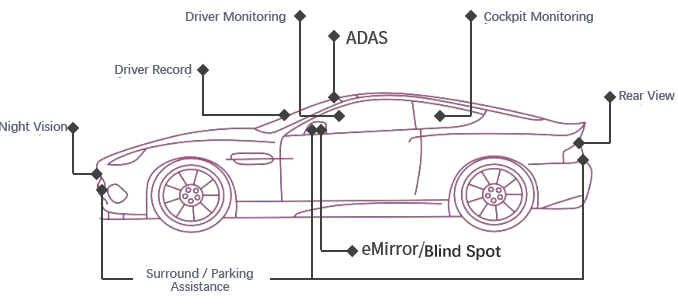

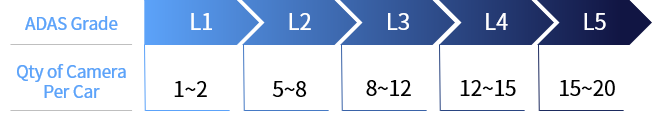

With the gradual popularization of ADAS, the in-vehicle market will become the largest incremental market for CIS. In the future, as more new cars are equipped with high-speed automatic driving, urban automatic driving, and memory parking functions, the demand for in-car and out-of-car perception will be further enhanced. Generally, more than 11 cameras are required for L2 + and above, and more than 15 cameras for L4 and L5. In-vehicle cameras have brought disruptive contributions to ADAS. In the future, the current market will be divided into various system solutions, such as machine vision applications, rear-view applications and in-cabin monitoring applications.

According to GGAI statistics, it is estimated that from 2018 to 2025, the shipments of domestic front-view ADAS cameras will increase from 3.3 million to 75 million, the shipments of scanning cameras will increase from 15 million to 170 million, and the shipments of built-in cameras in cockpit will increase from 1.8 million to 46 million.

1、Forward view

Considering increased computing power, increased front-view functionality, and relative cost advantages, over 16 million passenger vehicles are expected to be equipped with front-view systems in China by 2025, representing an installation rate of 65%.

2、Looking around

In 2020, China has 3.398 million volume vehicles equipped with surround view system, with an installation rate of 18%. With surround view systems replacing mirrors and their added parking-type functions, 360° surround view + ultrasonic solutions have become the mainstream solution for parking functions, and surround view has entered a new phase of development, with the installation rate expected to rise to 50% by 2025.

3、DMS

According to ResearchInChina, more than 10 new passenger car models in China are equipped with DMS, and last year, 173,000 vehicles were equipped with DMS, representing an installation rate of 0.9%. By 2025, the installation rate is expected to rise to 20%.